How to Build a Simple Emergency Cash Reserve at Home

28th Nov 2025

Building a small cash reserve at home is one of the easiest preparedness steps you can take. Power outages, card failures, and unexpected situations happen — and having a little cash tucked away can take the pressure off. The key is keeping things simple, discreet, and safe.

Below is a quick, friendly guide to help you set up a small emergency fund you can rely on anytime.

Why Keep a Small Cash Reserve at Home?

A little backup cash can help with:

-

Basic purchases during outages

-

Paying for fuel or groceries when card terminals go down

-

Emergency travel

-

Unexpected service calls or repairs

-

Peace of mind knowing you have options

When kept small and well-organized, this kind of reserve is easy to manage and doesn’t feel overwhelming.

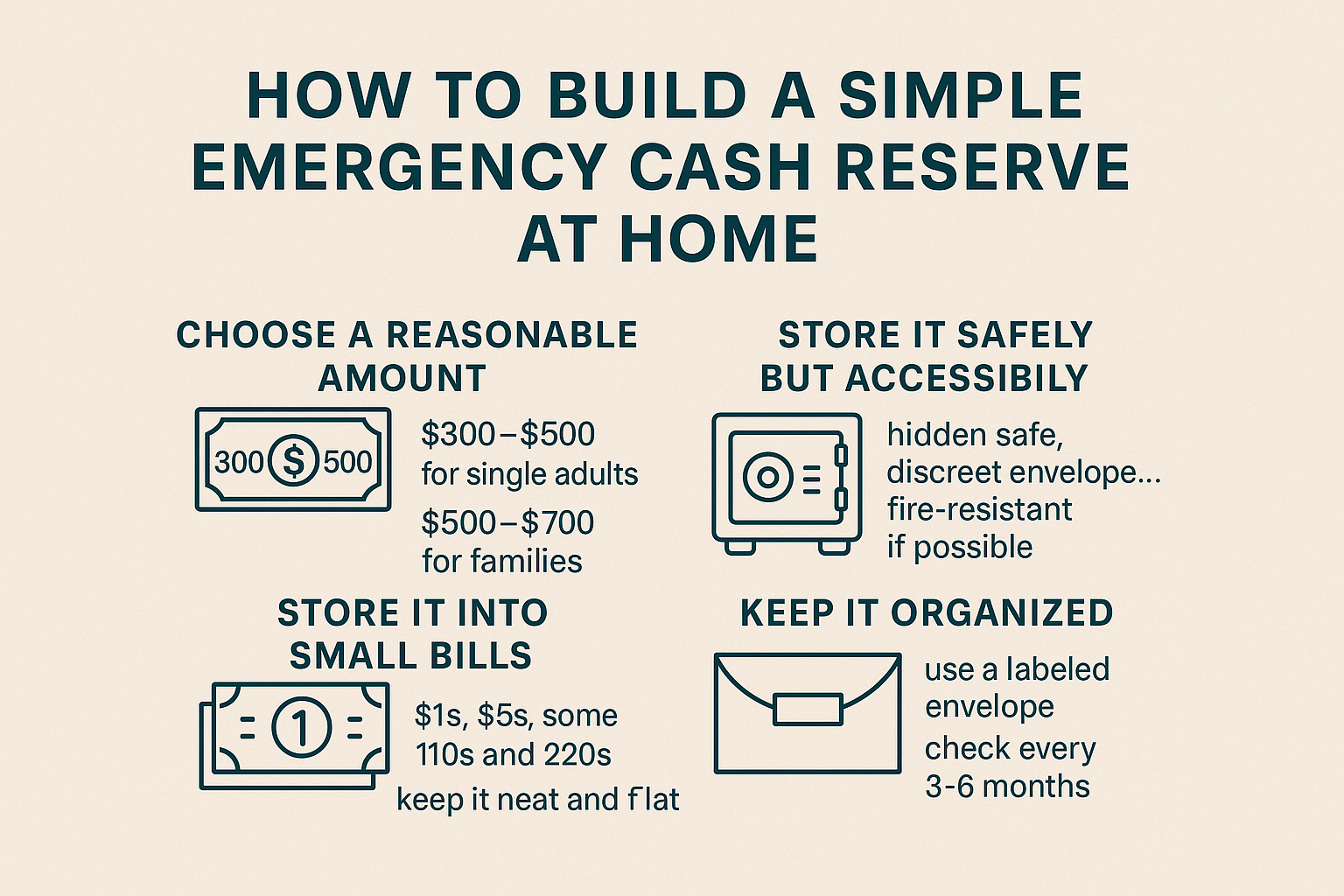

Step 1 — Choose a Reasonable Amount

For most households, a helpful starting range is:

-

$300-$500for single adults

-

$500–$700 for families

Pick an amount that feels comfortable — enough to be useful, but not so much that you’re worried about storing it.

Step 2 — Break It Into Small Bills

A practical mix makes your cash far more usable:

-

$1s and $5s for quick purchases

-

Some $10s and $20s for flexibility

-

Keep it neat and flat to avoid wear

Having small denominations keeps your emergency fund truly functional, especially if a store can’t make change.

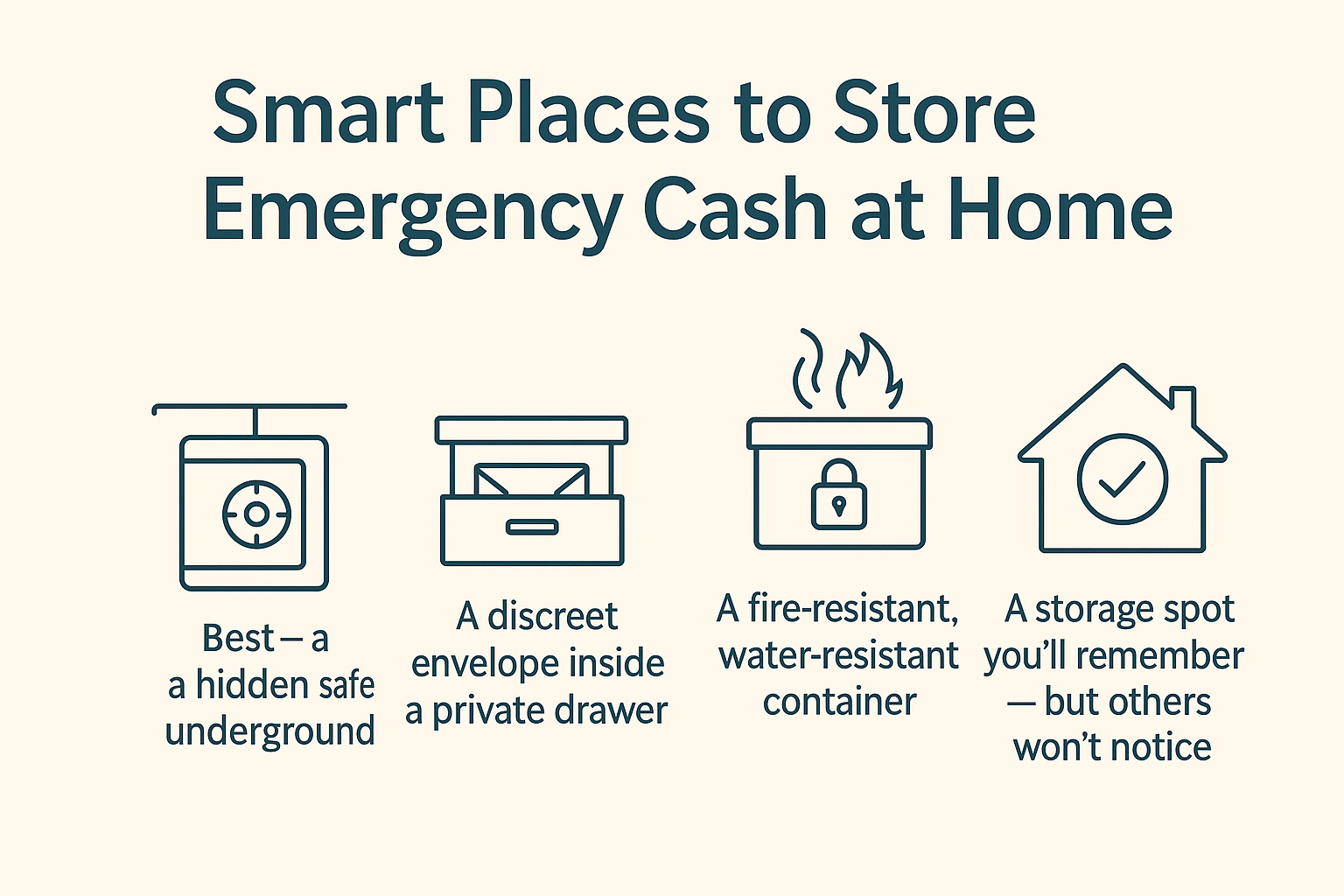

Step 3 — Store It Safely but Accessibly

This step should feel reassuring, not stressful. Good options include:

-

A Small Hidden Safe that is not kept in the house, thieves can find anything inside the home

-

A discreet envelope inside a private drawer

-

A fire-resistant, water-resistant container

-

A storage spot you’ll remember — but others won’t notice

Aim for a spot that keeps cash dry, organized, and protected… while still easy for you to reach if you need it quickly.

Step 4 — Keep It Organized

A simple system gives clarity:

-

Use a labeled or color-coded envelope

-

Keep bills facing the same direction

-

Add a small note card with the total amount

-

Review it every 3–6 months

This keeps your reserve tidy and prevents confusion later.

Step 5 — Tell Only One Trusted Person (Optional)

You don’t have to share your location — but if you choose to:

-

Limit it to one trusted person

-

Share only what’s necessary

-

Keep the amount private

This helps in cases where someone may need to access the funds on your behalf.

Step 6 — Replenish After Use

If you dip into the reserve, simply top it back up the next time you’re able.

A good habit is to:

-

Replace used bills promptly

-

Keep the total consistent

-

Avoid borrowing from it for everyday spending

Consistency keeps the system working smoothly.

A Simple Step That Brings Real Peace of Mind

A small emergency cash reserve is one of those quiet upgrades that makes everyday life feel more secure. With just a little preparation, you'll have a ready backup for unexpected moments — no stress, no complication.

If you want a discreet, durable way to store essentials, explore hidden safe Options that protect cash, documents, and valuables right at home.